Millennials include fiscally conservative, savings oriented, and future planners seeking financial freedom as core attributes. A large part of millennials’ formative years was influenced by the US sub-prime mortgage crisis beginning in 2007, shortly followed by an international banking crisis, which led to what became known as the Great Recession. The millennial generation would have ranged from ages 11 – 26 years of age when this economic downturn began. Living through this economic volatility, not seen since the Great Depression, gave rise to the fiscally conservative millennial mindset. The other socio-economic force that continues to shape the millennial fiscal mindset is the student loan crisis. Cbinsights.com finds 41 percent of millennials carry student loan debt for which there is no personal bankruptcy relief. This debt crisis places unique financial pressures on nearly half of a generation, and many are seeking new ways to manage their income, debt, and future savings.

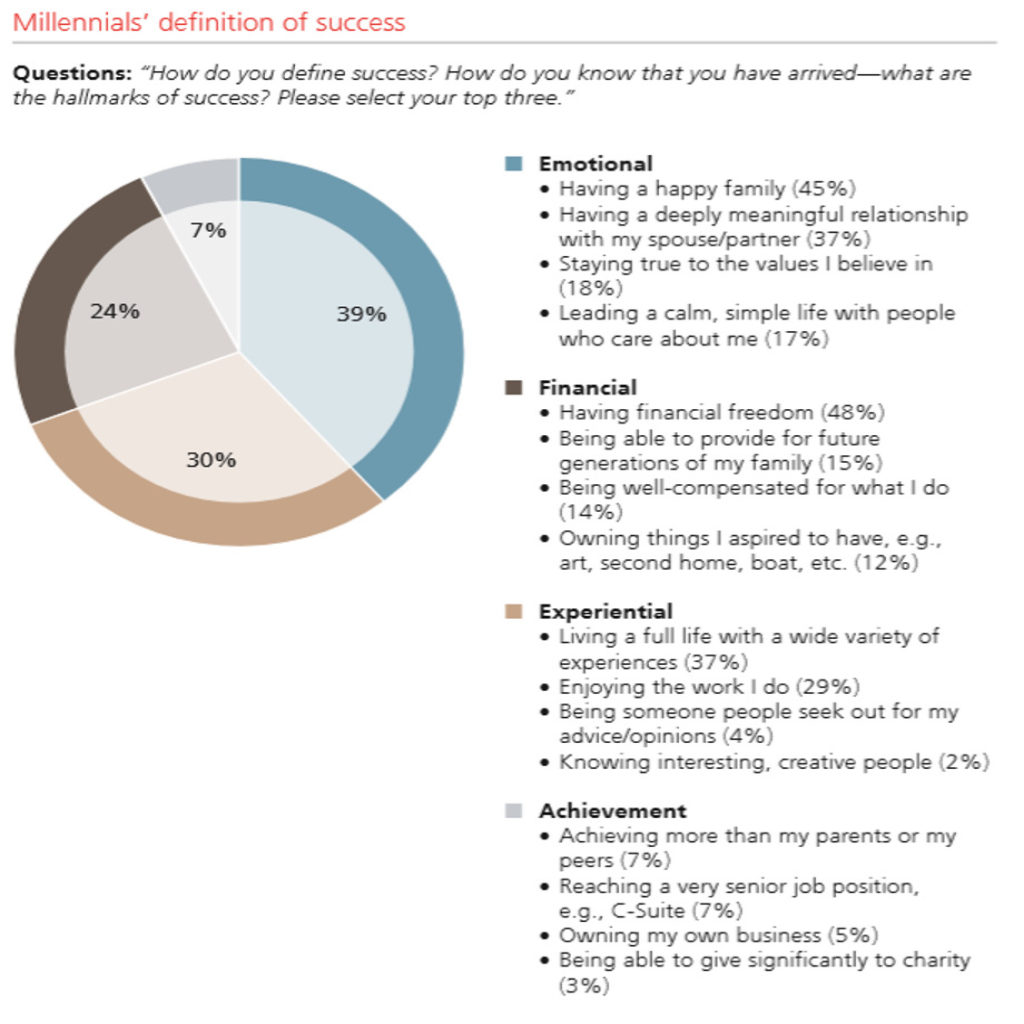

This conservative mindset has underpinnings of investment optimism about achieving financial goals according to reporting by the Union Bank of Switzerland Investor Watch report (UBS), and millennial goals are different from generations before them. The definitions of what being successful include a focus on personal success rather than maxing out returns on investments. This personal success is a balance of financial, relationship, and experiential factors, prioritizing long-term financial considerations like retirement or caregiving aging parents. Millennials understand their number one goal is to attain financial freedom, with a conscience. The UBS report goes on to say that 78 percent of millennials are more likely than other generations to believe income is a critical success factor and feel that income should be about 220,000 dollars to be considered a success. Millennials are also more apt to think money can buy happiness because their pursuit of money is geared toward financial freedom rather than excessive accumulation.

According to Forbes, many mid-life millennials (late 20’s and 30’s) are changing the order of, or opting out of traditional family and financial milestones of their predecessor generations. Some will have children before marriage; others will resolve all debt (think student loans) before entering into homeownership, and most will invest with sustainability and environmental concerns at the forefront of decision making. As the oldest millennials turn age 40 in 2020, many are conducting personal financial checkups, taking stock of their assets, liabilities, and insurance needs. Re-evaluation of and adjustments to financial plans help to ensure financial goals can be met.

Though most millennials do not yet have a professional financial advisor, ten self-directed steps can help to evaluate your current financial plans and make any necessary adjustments.

- Specifically, relist your financial goals and work backward from them to see what financial processes you need to put in place to achieve those goals. Embrace learning and be patient as you track your spending, pay yourself first, and break long term goals into short achievable steps.

- Think about life insurance. What will happen to your family or loved ones in the event your family has to survive without you and the income you provide? A death benefit will provide financial stability and help them to survive.

- If you have not already done so, make a will and include medical directives, and consider a durable power of attorney should you become incapacitated.

- Revisit the parameters of your current budget, and if you are willing, get outside professional input as most people’s expenses are higher than they think. There is a human tendency to overlook some existing expenditures and not be aggressive enough when it is time to make cuts in spending.

- Assess and update your investment choices. Particularly pay attention to your 401(k) plan and other retirement savings vehicles like IRAs. Confirm they are aligned to your risk tolerance and perhaps reduce the number of high-risk equities into slower, high-dividend stocks. Look at the advantages of adding an annuity into your 401(k) plan and other changes that the SECURE Act of 2020 brings to retirement planning. Understand that the old model of 60 – 40 equities to bond ratio is no longer deemed advisable.

- If you have excessive credit card debt, address it now. Pay down the highest interest balance(s) first if you are servicing debt as opposed to attacking a principal payment.

- Do you have student loans? Again, pay down the highest-interest loans first by monthly auto-deducting it from your checking account. Explore the possibility of consolidating multiple student loans into one payment and negotiate a lower rate and longer time to pay lower monthly payments.

- Weigh the costs of homeownership. Some millennials, particularly those without children, may prefer not to be anchored to home real estate, maintaining the flexibility of movement for job opportunities. Those who want a home must assess financial responsibilities beyond the costs of a mortgage and real estate tax, considering the workload and cost of home upkeep.

- Review your health insurance, and be sure it is adequate to cover your family’s needs. Children especially are subject to many doctor visits and requirements for attending school with proper vaccinations. If you are fortunate enough to have health insurance through your employer, check that the deductible and co-insurance options make the most sense for your situation.

- Finally, take a good look at your health situation. While this doesn’t sound related to finances in the long run, it is. Is your diet unhealthy, and are you overweight? These factors potentially set you up for the likelihood of diabetes two and future joint and mobility problems. Are your cholesterol and blood pressure numbers in a healthy range? Do you need to reduce alcohol intake? Do you work out consistently in the three formats you need, which are weight training (strength building), aerobic exercise, and a stretching routine like yoga? Being as physically healthy as possible reduces overall health costs.

Millennials are at the cusp of their middle age planning stage of life and realizing that life’s priorities are a moving target. While the above pertains to millennials, the importance of planning – both legal and financial – is critical at any age.

We help families of all ages plan for what is important to them, and to make sure their plans and wishes and properly documented. If you’d like to discuss your particular situation, please contact us or schedule a FREE 30-minute consultation with our Huntington Beach law firm. We’d be honored to help.